You can find out all kinds of information about stocks on the Internet, but before we get started, let's review some vacabulary. For each term I will give examples from Apple stock.

Here's the listing:

And here's what it means:

| Example | Name | Definition |

|---|---|---|

| Apple Inc. | Name | The name of the company |

| AAPL | Symbol | The short name used to look this company up. Lots of names like "Apple" are ambiguous and might refer to more than one company, but the stock symbol is unique. For example, there are quite a few companies with Apple in the name. There is a record company, and a temp agency, and various companies that actually produce Washington Apples. |

| $353.56 | Price | The price of a share of stock. This will vary from day to day. |

| +$1.57 | Change | The change in price for this stock for today. |

| $352.50 | After hours | Price of the stock at this moment, after the stock market has cloased. The market closes at 1 pm Pacific time. I took this snapshot at almost 5:00 and this was the price at that time. |

| -1.06 | Change after hours | The change in price for this stock for today after closing time. |

| 17.91 | EPS | Earnings per share. This is the total earnings of the company, divided by the numbers of shares. If you own one share of this stock, this is the amount of earnings that is your share. That doesn't mean that this amount is paid to investors. There are some companies that lose money and have no EPS. This is opinion only, but in my opinion, there's no reason to invest in a company if they aren't making profits. An example of a company in this category is Barnes and Nobles (BKS). There are a lot of people that don't agree with me on this, but I'm expecting BKS stock to go down because they have high expenses and are not making a profit. |

| 0 | Dividend | This is the amount of profits that the company pays to investors each year. Some companies pay dividends, but some like Apple, don't. They figure that if they hold onto the money, they can reinvest it, and your stock value goes up. It seems logical that a company that has just earned $17.91 will increase in value this much. For investors, it's better to take the profits in this manner for tax purposes, because they pay tax at the capital gains rate, currently zero. This is really great for rich people who own stock. If you take the profits as a dividend you have to pay regular income tax which would probably be more. On the other hand, some people argue that a company that pays no dividend isn't worth investing in. I suppose in the long run they are right. |

| 19.4 | P/E | Price to Earnings Ratio. This is the amount you would have to invest to own $1 of profits in this company. If the price to earnings ratio is low, this means you get a lot of profits for not much money. If the price to earnings ratio is high, this means you have to pay a lot to get a dollar of profits. Typical solid companies might have P/E ratios in the range of 10 to 20. Microsoft, Starbucks and McDonalds are in this group. High growth startup companies might have higher ratios up to 45 or 70 or even higher. It means they aren't making much now but investors think the sky is the limit. A P/E ratio of under 10 means people think this company is in trouble. There are a number of shipping companies that are in this group. In my opinion, the P/E ratio for Apple should be at least 25, due to its consistent profitability and rapid growth. I think this stock is undervalued (a bargain). This is just an opinion, but for me, P/E is one of the best measures of the value of a company. If a company has no profits, it's P/E ratio is undefined and the reason for investing unclear. Maybe you think they are going to become hugely profitable next week. Krisky Kreme (KKD) and Barnes and Nobles (BKS) often lose money and have no P/E ratio. I heard KKD actually made a few dollars this past year. If there are no profits, you should seriously question why you are investing in the company. The P/E ratio changes every time the price of the stock changes. |

| 323.14B | Market Cap | This is the total value of all stock that exists for the company, and is the measure of the total value. In theory, if you wanted to buy the whole company, this is what you would have to pay to buy ALL the shares. Of course, in reality you might have to pay a bit more, because some people would not want to sell. Stil, it is a very good measure of the total value of the company. For Apple it is a huge 323 Billion Dollars, more than the value of plenty of small countries. |

| 921.28 M | Shares | This is the total number of shares that exist. So, you get market cap by multiplying the share price times the number of shares. |

| 15.59 | Volume | The number of shares bought and shold today. This doesn't tell us much about price or value on the stock. Apple is a popular stock so lots of shares change hands each day. |

| 1.3 | Beta | The beta measures how closely the stock follows general price trends in the stock market. A stock with zero beta moves randomly with no relationship to the stock market in general. A stock with beta of 1 moves in lock step with the market average. Stocks with zero beta have higher risk and higher diversification value. |

There are many website that carry stock information. These are some of my favorites:

| Name | URL | Description |

|---|---|---|

| New York Times | www.nytimes.com | A leading newspaper that has both listings and news stories about many current stocks. We will be using their portfolio service in this class. |

| Google Finance | www.google.com | Google has a finance section that lists real time stock quotes and a lot of other information about stocks. If you have Google set as your search engine for your web browser, then you can quickly look up a stock by typing the symbol (such as APPL for Apple Inc.) into the search box. Google was the first company to offer real time free stock prices. Until recently most other companies only offered stock prices that were 15 minutes delayed. |

| Yahoo Finance | www.yahoo.com | Yahoo also has a really good stock report. |

| MSN Money | moneycentral.msn.com | MSN also has really good stock reports |

| CNN Money | money.cnn.com | CNN also has good stock reports |

| Wall Street Journal | www.wsj.com | The most popular Wall Street newspaper. |

| Barrons | online.barrons.com | Another business magazine site |

| The Street | thestreet.com | Various stock related news articles |

| Motley Fool | www.fool.com | Various articles and recommendations on stocks. Articles tend to be very opinionated yet opinions can be very interesting. |

In this section we're going to wander from established facts into the area of speculation and opinion.

I'm going to talk about how to select stocks. I'm not stock broker or a professional stock expert, and so you should only take this discussion as a fun conversation designed to stimulate your curiosity and get you to investigate the world of stocks. You are welcome to make your own theories, and your ideas are likely to be as good as mine.

I like to look for stocks that make money. The reason a business is in business, is to make money. When you buy a stock you are buying a share of the profits of a company. If you know how much money a company is earning, if you have some feeling for what the profits are going to do in the future, and if you know the earnings per share, then you should be able to get some idea of what the price of the stock should be.

For many solid companies, the ones we call "Blue Chip" stocks, P/E of 13 might be typical. This means that $13 of investment will buy you $1 of profits. If you turn this upside down, it's equivalent to an interest rate on your investment of 8 percent. This doesn't necessarily mean the company is going to pay you this money right away, but it means they are earning that much profit and as the company earns money and grows, the value of your investment grows too.

Different industries have different P/E ratios that might be typical. P/E of 13 might be typical for a company like McDonalds. In the shipping industry, where things are a mess right now, P/E is more like 6, which reflects a widespread fear that this industry will collapse.

Then we should also consider growth rate. Companies like Amazon and Ebay and Apple are growing quickly. That ought to be worth something.

Amazon has a P/E ratio of something like 90. You pay a lot for one dollar of profits, but there is an expectation that the company will grow, so people are willing to pay more.

Ford has a P/E ration of 8. People consider that the car industry is in trouble and all manufacturing will move to China. If you think the industry has a future, this may be a good investment opportunity.

Apple has a P/E ratio of 16. They are growing rapidly with no slowdown in sight. ON top of this they have huge amounts of cash in the bank. Most companies are up to their eyeballs in debt. The P/E ratio is 16. It's a little higher than McDonalds but with more growth and no debt. In my opinion this stock is a good buy.

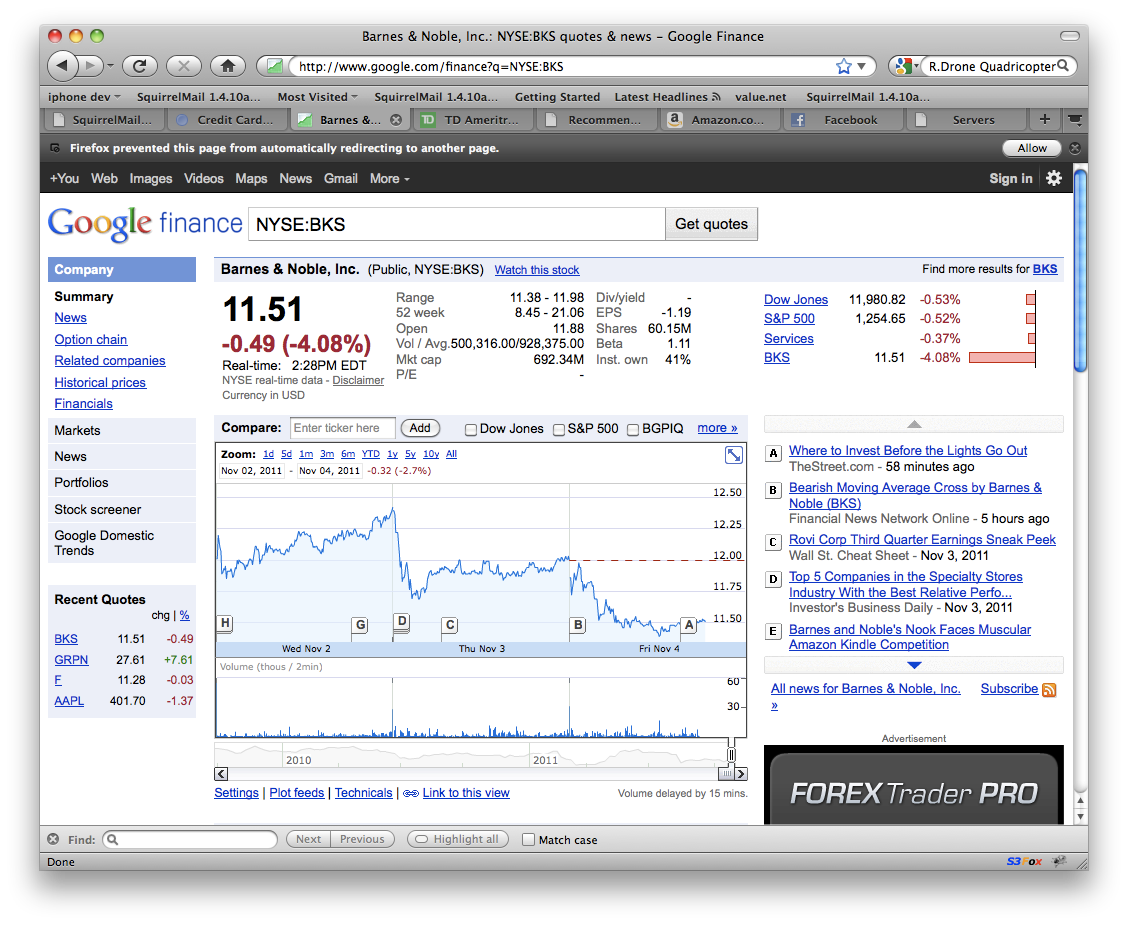

Sometimes you will see stocks that have no profits at all, and they may make an opportunity for "selling short", which is a bet that the value of the stock will go down. An example is BKS, Barnes and Noble. They lost more than a dollar a share last year, and don't seem to be doing any better this year. The stock is currenly selling for about $12 a share. It might be a good chance for selling short. Obviously there are people who disagree. Only time will tell who is right.

Sometimes you will see pricing patterns that lead you to believe that some rich person is intervening in the stock market, to cheat the price up or down. The big brokers all will deny that this is true, but you see it all the time.

For example, here's today's price graph for Barnes and Nobles. About 90% of the stock of Barnes and Noble is privately held by about five big investors, and they seem to intervene regularly to support the price of the stock.

Look at the price graph. While it jiggles around all the time, there are certain points where it flattens out. These look to me like someone is supporting the market buy buying up stock, to prevent the price from going into free-fall.

Why would they do this?

Well, only a small number of shares is traded, and a small number of shares can determine the price of the stock. If the share price starts dropping, then can step in and support the price at, for example, $11.90. If anyone tries to sell the stock for less than that, they buy it up and cause the price to stabilize.

Is this legal? Probably. I don't know. This kind of thing seems to happen all the time.

Is it worth it for them?

Obviously they think so. Keep in mind, this company is basically for sale. They have publicly announced this. They need to keep the price up so that when they sell the company they get a better price.

What does this mean for me as an investor?

For me it's an opportunity. If they are pumping up the price, to a higher price than it should be, then I should sell short, which means, I want to bet that the price is going to go down. If they've artificially inflated the price, there's a pretty good chance that it will eventually go down. So their attempts to pump up the price simply give me a chance to sell the stock for more than it is worth, and that's good for me.